It’s one thing to splurge on fabulous shoes, a new iPhone or a scrummy bottle of wine.

It’s one thing to splurge on fabulous shoes, a new iPhone or a scrummy bottle of wine.

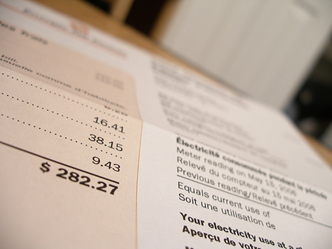

But it’s just plain dumb to waste your money on penalty charges or excess interest because you were late paying a bill. All it takes is a little organization and a shred of planning, and you can save your dollars to squander in ways that really matter to you. That’s what I do!

Here are 6 simple steps to get it done.

Get Organized to Pay Your Bills on Time

- List all your regular bills. These might include mortgage/rent, utilities, internet, cell phone, landline, car loan payments, credit card payments, subscriptions, etc.

- Identify the ones that can be auto-paid from your back account or credit card, and set these up. (This info will be on the back of your bill or may be available online.) Some you’ll be able to arrange online, others by phone, and some will need an ancient type of admin called ‘a form’. Don’t fight it – whatever effort you make now will be worth the saved time, money and hassle. (Um, it goes without saying that you need to be able to cover these bills from your credit card or bank account. But I’ve said it anyway.)

- If you’re lucky, all your bills will be automatically payable. For any that aren’t, set up internet banking or phone banking to pay these bills at your convenience.

- When a bill arrives, check whether it will be autopaid. (The bill will say something like: ‘Payment of $287 will be made by autopayment from your credit card on 28 November 2008. Please ensure funds are available on this date.’). If it’s a pesky one that can’t be autopaid, diarize the due date. If you use something like Outlook you can set a reminder, too. And on the due date, pay it.

- Alternatively, if you have several bills that aren’t able to be autopaid, you might prefer to save time and batch the tasks by paying them all at once, online or by phone (but before the earliest due date).

- Bonus step: Since credit card payments are often at the higher end of interest charges, pay them off in full in each month if you can.

Feels great to have your bills well organized, doesn’t it! I suggest you reward yourself with something nice. 🙂

Image by brendan.wood